Donations & Help

Can you spare £1 every month to help the hedgehogs at Prickles in a Pickle ?

We are introducing Payday Pledge, an opportunity for our supporters and all hedgehog lovers to pay from £1 a month on direct debit to Prickles in a Pickle, this can be timed to be the same day you get paid or suits you best.

Regular funds will mean we will know we can pay the vets bill each month, or any emergency surgery etc.

We have over 3700 followers on our Facebook page. Just imagine for one moment that each of these people donated £1 a month via Payday Pledge = £3700. Even if a third of you all did £1 a month it would honestly change our world, which in turn gives more hedgehogs a second chance to live happily in the wild.

As a Registered Charity we rely on donations to provide essential care for the rehabilitation and safe release of Hedgehogs.

Hedgehogs are in serious decline and are now officially vulnerable to extinction. Prickles in a Pickle is a homebased Wildlife Sanctuary which has become busier and busier over the years, especially with sick hedgehogs. Our charity is funded by donations and we need your support but there are other ways you can help.

On average it costs £57 to nurse and rehabilitate a hedgehog.

You can donate by either a one off donation or a monthly subscription by choosing one of the options below. Alternatively you can make a donation by bank transfer, our bank details are below. .

Prickles in a Pickle

Sort code: 08-92-99

Account No: 65930173

If you are a UK tax payer you can boost your donation by 25p for every £1 you give by completing the Gift Aid form at the bottom of this page. Thank you very much!

Wishlist

Over recent weeks we have been able to get collection boxes up and running at several large shopping stores. Some are in the process of being set up too. Below is a list of stores where we will have collection boxes. We appreciate any items from the list, however small. Thank you! Boxes can be found at (or soon to be found at):

Tesco Lee Mill – Ivybridge

Tesco Transit Way – Plymouth

Nature’s Larder – Ivybridge

Morrisons Superstore Plymstock

Sainsbury’s Dartmouth

Tesco Kingsbridge

Thank you from Judy, Alan and the whole team at Prickles In a Pickle.

Donations and Gift Aid

Boost your donation by 25p for every £1 you have donated.

If you are able to and wish to Gift Aid your donation you can do so by completing the interactive form below – or, for more details and claim forms go to Claiming Gift Aid as a charity or CASC: Gift Aid declarations – GOV.UK (www.gov.uk) to download a form. Complete the declaration and either send to us by post or email.

Lifetime Gifting – Do you Know the Benefits for You?

Making gifts in your lifetime to a Registered Charity like ours can save Income Tax, as well as potentially reducing the amount of Inheritance Tax your loved ones may have to pay. Gifting to Registered Charities is immediately free of Inheritance Tax, so there is no need to survive for 7 years for it to be outside your estate. If you agree to use Gift Aid for any donation made from your taxable income, Prickles in a Pickle will also receive the 20% Income Tax you would have paid which is added onto the amount given. In addition, if you are a higher rate taxpayer, you can reclaim any additional tax via your Tax Return, so this really is a win-win situation!

Your local business can support Prickles in a Pickle the local hedgehog rescue and make a difference!

Did you know that aligning with a wildlife rescue can enhance a company’s reputation for social responsibility and environmental awareness.

Supporting a cause like wildlife rescue can boost employee morale and engagement and it strengthens ties with the community and demonstrates a commitment to local well-being

Becoming one of our business partners sends out a very public message of your commitment to helping protect British wildlife. At the same time, you will be reinforcing the positioning of your business as a purposeful, socially aware organisation that takes responsibility for the world we live in and that works to make a real difference.

Your customers and your staff alike will love the thought that you are partnered with Prickles in a Pickle, a local charity that saves hedgehogs, supports the environment and offers work placements to local adults with learning differences, Duke of Edinburgh placements to the local school students and work experience to college students.

Not only do we save and rehabilitate over 1300 hedgehogs a year, but we also educate local community groups and primary schools on protecting the environment and helping save nature in their own gardens.

What you can do for us:

Your business could become one of our business partners sponsoring the work we do, linking your business to one of the most popular wildlife charities in South Devon.

Help save the British Hedgehog from disappearing from our countryside and gardens.

Enabling us to educate more community groups and schools.

Ensuring we can always give every hedgehog the very best second chance.

Have in-house office fundraisers throughout the year to raise money for Prickles in a Pickle.

What we will do for you:

Promote your business to our loyal supporters via links on our website and social media – over 4.9k followers on Facebook with post having 32,000 views a month.

Put links to your business on our website enabling all our follower’s easy access to your business website.

Be partnered with a well-run local charity, giving your business valuable association with Prickles in a Pickle and boosting your profile by supporting a local Charity.

Donations to registered charities, including those supporting wildlife rescue, may be tax-deductible

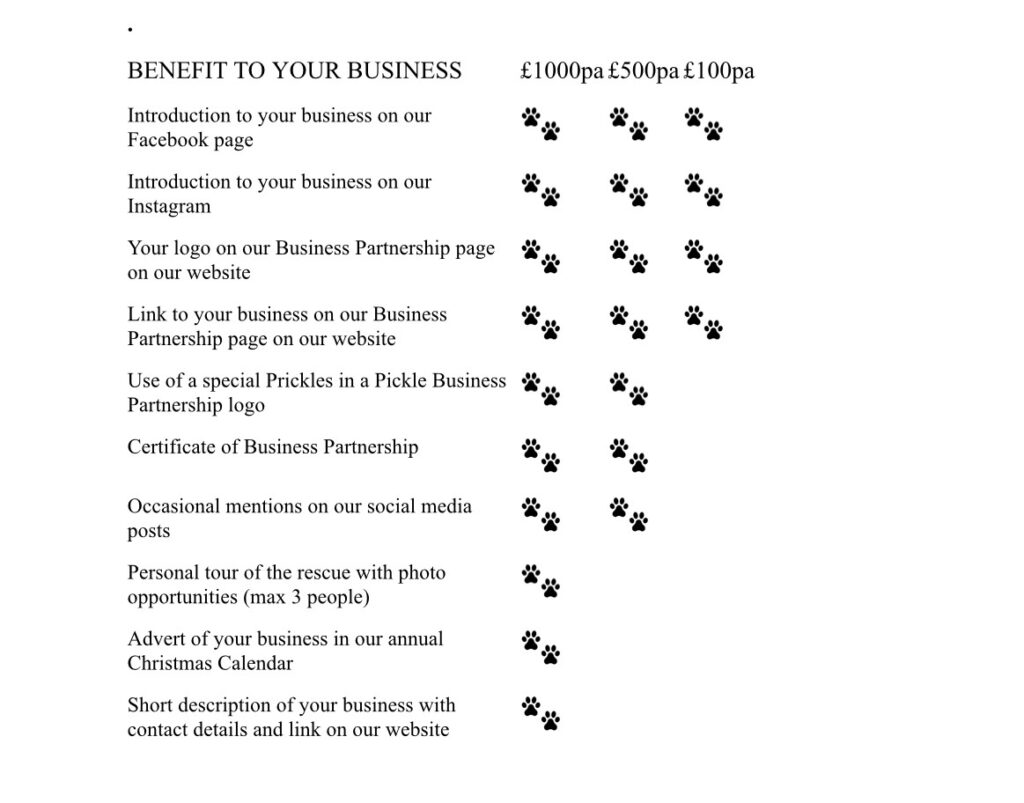

Packages start from only £100 a year- here are the range of packages and their associated benefits to your business.

Business Partnering Packages

Charity Gift Aid Declaration

Please read before completing the form below-

Please notify the charity if you:

*Want to cancel this declaration

*Change your name or home address

*No longer pay sufficient tax on your income and/or capital gains.

If you pay income Tax at the higher or additional rate and want to receive additional tax relief due to you, you must include all your Gift Aid donations on your Self Assessment tax return or ask HM Revenue and Customs to adjust your tax code.